How to create a banking app like Revolut?

Banking has been reimagined by apps like Revolut, and no wonder why they are so much more popular than their offline counterparts. Revolut is a complete banking solution, and more to that regards with its features like a self debit card and cryptocurrency payments. If you are planning to enter the fintech space, an app like Revolut can be the perfect way to do it, depending on your idea of course. Revolut is valued at over $5.5 billion, and it is expanding to various other countries, which certainly makes how to create a banking app like Revolut a very popular question.

Like any other banking app, the features remain the same, the difference comes on in as added features. You would also have to ensure your app can do everything for the customers, which is a commonality between all the Neobanks. You will have to intricately plan the app so that all the bank related transactions and tasks are available within the app. Neobanks have gained pace since when everything started to go online, physical banks are no longer seen as a necessity, thanks to apps like Revolut which showed the public what’s possible.

What are Neobanks?

Neobanks are banks which run online, they do not have any physical branches to visit for the public. All transactions are done through their applications, and all generic banking services are usually available well within the app. Just as we have seen with what eCommerce is to offline commerce, neobanks are to the generic banks, while there may still be offline retail stores in case of prior, there are no physical bank branches in case of neobanks.

What makes Revolut so popular?

With all the features that Revolut offered, it ought to be an idea that would succeed. There haven’t been many banks like Revolut which supports cryptocurrencies, neither were those who gave users debit-cards usable in over 120 countries. These small features and an amazingly usable and customer-centric mobile app could have been the key to the popularity of Revolut. The app also includes a 0mark up trade in stocks now, which makes it one of kind all in one money management solution.

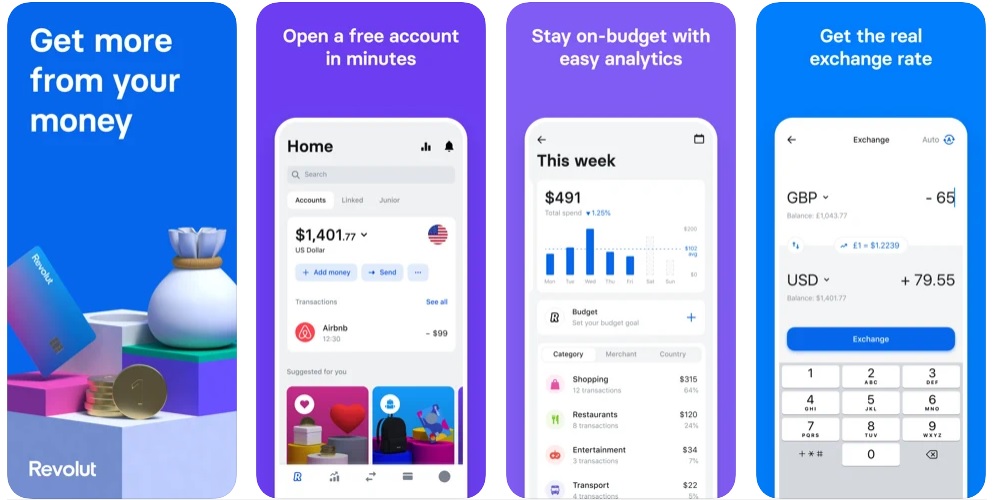

Image Source

Features to include in an app like Revolut

The feature list of a neo-banking app has to be picked very specifically, as a missed feature could be treated as an infringement of trust, and you certainly do not want it as a neobank. Missed features would also have a lot more customer queries, which puts the purpose of opening a neobank to waste. To ensure your app features everything necessary, make a clear list of what you are going to offer, and make sure every part of it is included in the app.

The first thing to figure out is the audience you are targeting, while mid-age adults and young adults learn quickly and can comprehend 100s of features, you need to figure out a way to do it simply for the elderly. A bank is open to all and should be for that instance, what you can do is make the app turn in on a simpler model, for one someone elderly is using the app. Apart from the features mentioned below, make sure you give a personal touch to your app, to make it stand out from the competition.

The features that should be included in your neobank application

1. Crypto Payments

Revolut allows you to pay directly in the form of cryptos from your bank account while charging a nominal fee. With so many people drifting towards cryptocurrencies, this is certainly a must-include feature, and we must say Revolut has done a great job by including it. When you get your banking app developed, make sure the APIs are well implemented, the prices of cryptos vary each second.

2. Personalisation

The top choice of those choosing between banks has always been personalisation. Be it personalised offers, cards, apps, and whatnot. What you want to do here is ensure the app you create is personalised based on the user. If your main target audience is elderly, make the main app simple to use and you would see a likeability towards it.

3. Splitting Bills

Splitting bills is a major need for those going out often, and in today’s world who doesn’t? A check splitting feature would be essential in a banking app in today’s age, and not many cares to include it. You should consider making your mobile app development teamwork on the feature to perfect it, as the current implementations don’t work really well, or aren’t as appealing as they can be.

4. QR based Payment

QR based payment is supported in multiple apps, and is a must include when building your banking application. QR codes are quick, and see a lot of potential in the coming time. You can in the future imagine merchants downloading your app, and the buyers directly paying them through an encrypted QR code. This feature can be a real game-changer, especially with the potential it holds.

5. 24/7 Support

While even some offline banks don’t provide it, it becomes a necessity of neobanks to include a 24/7 support to the customers. This becomes a necessity to ensure the processes run smoothly. While the whole concept is new and hard to catch up with, the least thing to do is offer proper support. A neobank doesn’t have to have limited banking hours, so shouldn’t be the limited support hours.

6. Foreign Exchange

Exchange over 29 currencies on the inter-bank exchange rates in Revolut, how you would want that in your banking application depends on you. This is a major feature with differentiated neobanks with other banks, you will have to sign deals for other physical banks to allow currency exchange on inter-bank rates if you want to include this as a feature.

7. Personal Debit Card

Since the whole concept is new, people thought that neobanks would not be able to provide debit cards. Revolut gives users an ATM withdrawal feature in over 120 countries, and we believe it is a must to include this feature. The thought process should follow the users opting you as the only bank they want to keep an account in, and then add to the feature list.

8. Trading

One of the best features that Revolut included was to allow trading with 0 convenience fee. A lot of people invest in stocks and commodities, and giving this feature can draw in more and more users. A direct transaction from the bank account saves time and cost and would be essential in the coming time.

9. Security

As many layers of security as possible is the way to go for neobanks. While the banks don’t have physical branches, it makes it tougher for people to trust it with their money. You should ensure to invest as much as you can to tighten the security around your data centres and the application itself. People are also considering blockchain to be a part of fintech, you can opt for it as an added security feature.

10. Mobile Apps

Usable mobile apps is a feature so many banks lack, it almost feels like a privilege to a user if their bank does. With neobanks, things have changed a lot, and to catch up to that you need to invest in both web apps and mobile apps. While the point may seem out of context, many fintech startups hardly focus on perfecting their mobile apps, while it stays a top priority to do so.

Things to know before beginning actual app development.

1. Deciding the panels

While many apps feature only 2 panels in the neo banking segment, you can invest further and opt for more. The admin panel and the user panel are the two most prevalent, you can go ahead and add merchant panels, or segment user panels. Different panels would allow you to run multiple apps under a single name, and the one suitable could be downloaded per convenience.

2. Technology to choose

There are so many app development technologies out there, it can get pretty tough to choose one. While in a generic scenario we would ask our clients to go with cross-platform app development technologies, in this case, we would mostly suggest native apps. The reason for suggesting a more time and cost-intensive app development strategy is simple, to implement a stronger and secure app.

3. Who to get the app developed from?

As for the security, the source code compilations and secrecy are major concerns you would face in due time. To ensure the data remains secure you need to keep the source code secret, and this takes away the option to get it done from freelance mobile app developers. The best options are to hire a reputed mobile app development company or to build an in-house team which can do the job for you.

4. Government approvals

Since neobanks are relatively new, many governments might think against them, after all, it is the money of their people. Before keeping a target country as a part of your plan, make sure to go through the legislation and legal requirements. You will need a team of legal advisors for the same, and it is best to research before investing in case of a fintech startup.

5. Features to include

We provided you with a long list of features above, what to include and what not to remain at your decision. Make sure to keep the essential features, and you can add more as you update the app later on. Investing in hiring good mobile app developers will save you from spending extra in the long term, as they can keep the app components compatible with adding new features in the future.

Conclusion

It could be the best time to develop an app like Revolut if you are planning to enter the fintech industry. Neobanks are a relatively new concept, and with international boundaries being leapt through cryptocurrencies, it could be a great business opportunity. An app like Revolut is a perfect example of providing the users what they are really looking for. People have been tired of physical banks and this revolution of neobanks has just begun.

We are a mobile app development company with years of experience in the fintech industries. From the start of mobile app adoption, to now when neobanks are taking the stage, we have been through it all. If you are planning a mobile app for your banking business, we can help you to the fullest by creating a capable app for your business. You can contact us, and we would be happy to help you. We wish you good luck with your endeavours.